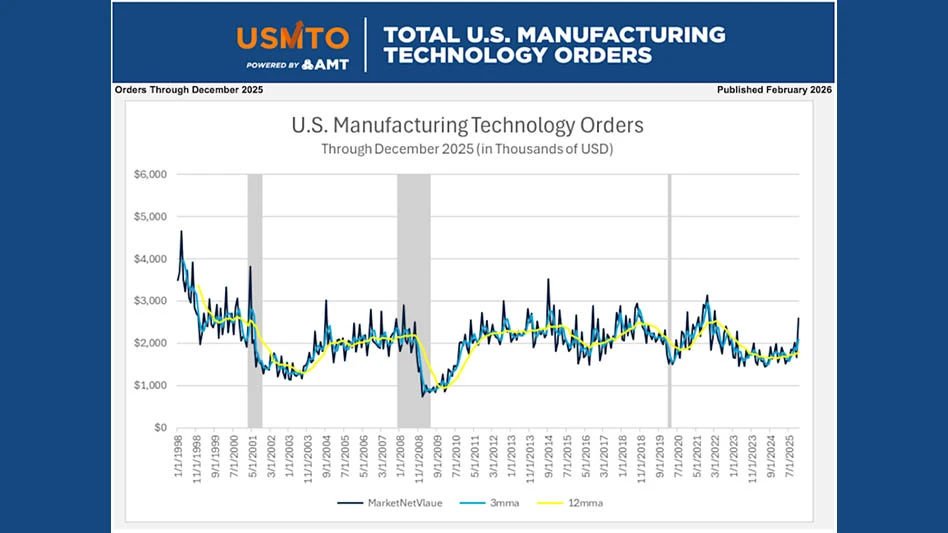

Photo courtesy AMT – The Association For Manufacturing Technology

New orders of metalworking machinery, measured by the U.S. Manufacturing Technology Orders Report published by AMT – The Association For Manufacturing Technology, totaled $814.3 million in December 2025, the highest monthly order value on record. The value of December 2025 orders grew 86.7% over November 2025 and 59.9% over December 2024. Through November 2025, the annual total had already surpassed the value of all 2024 orders by 5.1%. December orders brought the 2025 total value of machinery orders to $5.74 billion, beating 2024 by 22.5%.

While demand for manufacturing technology quickly rebounded from the 2020 COVID-19 recession, growing by more than half in 2021, it was followed by three years of decline, reaching a trough in the summer of 2024. The industry began to recover in September 2024 on the heels of IMTS – The International Manufacturing Technology Show. That pickup in demand at the end of 2024 was amplified in 2025 by a less restrictive interest rate environment, an easing of the uncertainty that gripped the middle of the year, and the passage of tax provisions favorable to capital investment.

Through 2025, the value of manufacturing technology investments followed a relatively linear upward path, whereas the count of units ordered had a slightly choppier journey: January had the lowest order value of the year, while unit trends showed a modest slump from May to August. These divergent trends indicate that the heightened uncertainty following the April 2 tariff announcement may have delayed some orders, but that large, longer-term investments were undeterred by rising uncertainty and political noise.

Orders from contract machine shops, the largest customer of manufacturing technology, grew 19.1% in 2025. This industry is a strong driver of unit growth, so its underperformance relative to the total market growth of 22.5% has contributed to the growing divergence between dollar value and unit trends. Conversely, the aerospace sector typically purchases high-value machinery that drives dollar-value growth without moving the needle on units as much as other customer industries. Growing factory shipments in 2025, along with ongoing capacity constraints, have led to 45.1% growth in manufacturing technology orders from aerospace manufacturers compared to 2024.

The fastest-growing industry in 2025 was commercial and service machinery, which grew 121.5% over 2024 levels. Among other equipment used throughout the service sector, this industry also manufactures inspection equipment heavily used in chip fabs.

The forces that propelled investment in manufacturing technology to new heights at the end of 2025 will continue to drive the market well into 2026, with single-digit annual growth expected. Machinery ordered in 2025 will begin to hit shop floors throughout the first quarter of 2026 and, combined with increased levels of industrial activity, are expected to push cutting tool consumption up nearly 5% in 2026.

Continued consumer demand and elevated investment in manufacturing technology lend credence to the Federal Reserve’s assertion that interest rates are approaching, if not at, the neutral rate as supply and demand forces in the economy move closer to alignment. If these factors persist as expected, a quite rationally exuberant manufacturing sector will convene in Chicago from Sept. 14 through 19, when IMTS – The International Manufacturing Technology Show opens.

Latest from Aerospace Manufacturing and Design

- High-performance HV fuses

- Fives and Prestige Equipment partner

- Precise command over how drawings are annotated, shared

- What’s happening in the defense industry right now

- Making workholding work for you

- CAE to deliver full flight simulator to Embraer-CAE Training Services

- Website helps users quickly search, evaluate, specify machine tool accessories

- HondaJet Elite II Emergency Autoland is FAA certified