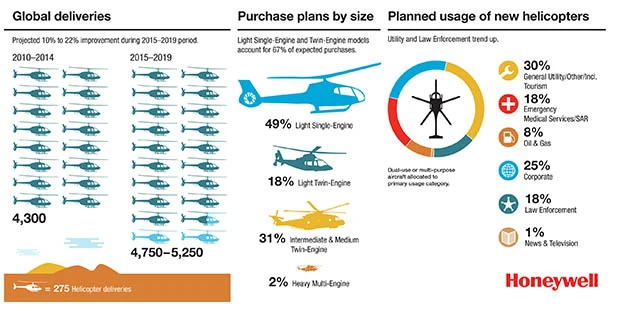

Orlando, Florida – In its 17th annual Turbine-Powered Civil Helicopter Purchasing Outlook, Honeywell Aerospace expects that 4,750 to 5,250 civilian-use helicopters will be delivered during 2015 to 2019.

Overall, five-year demand for turbine-powered, civil helicopters remains steady versus the 2014 five-year forecast, with moderate improvement in new helicopter purchase plans reported, offsetting the short-term uncertainty of large-fleet operators in the face of lower energy prices and fluctuating market currencies.

The forecast estimates the five-year share of demand from the U.S. and Canada at 34%, up nearly eight points on stronger North American buying plans. When combined with Latin America, the Western Hemisphere represents 53% of the five-year global demand. Europe's share tallies 24%, with the Asia-Oceania region accounting for 14%, and Africa and the Middle East contributing 9%.

Operators who intend to purchase a helicopter within the next five years noted that the age of their current aircraft (which includes factors such as maintenance costs, performance erosion, and safety concerns), contracted replacement cycle, and warranty expiration were all key reasons for their decision. For those surveyed, make and model choices for their new aircraft are strongly influenced by range, cabin size, performance technology upgrades, and brand experience.

"Near-term demand appears stable despite a pullback in 2014 deliveries and ongoing concerns with the energy sector," said Mike Madsen, president, Defense and Space, Honeywell Aerospace. "Purchase interest for helicopters in training, tourism, firefighting, and law enforcement categories is trending up, influenced by increased utilization rates and helicopter replacement cycles. Interest across these mission sectors is helping to sustain near-term demand. Looking ahead, several new platforms are scheduled to enter service over the next few years, also bolstering overall helicopter demand."

However, large fleet or "mega" operator requirements not captured in the survey offset some of the improved purchase planning results provided by survey respondents. The tumultuous changes in the energy sector, as well as emerging regional growth and political issues, have affected fleet expansion plans in select areas and are restraining some of the near-term expansion that was expected a year ago. As a result, total projected demand in the 2015 outlook remains roughly in line with 2014.

"With near-term demand for new helicopters running close to recent volumes, and aircraft lasting longer through replacement cycles, Honeywell is ready to support both new installations and fleet upgrades worldwide," Madsen said. "Our propulsion, safety, navigation, communications, and flight services can help aircraft stay efficient, powerful, reliable, and safe throughout their entire time in the air."

North American purchase expectations rose seven points in this year's survey and provided a strong base of demand for light single and twin-engine platforms. Planned improvement in North American purchases is a significant finding of the 2015 survey and helps support overall industry demand projections by virtue of the large fleet active in North America.

Operator Preferences by Class of Helicopter

- Light single-engine helicopters continue to be the most popular helicopter class, garnering almost half the new purchase interest in the 2015 survey. The Airbus EC130/AS350 series, Bell 407, Bell 505, and Robinson R66 were the most frequently mentioned models.

- Intermediate and medium twin-engine helicopters are the second most popular product class, with approximately 31% of total survey participants planning to buy a new model of this type. The most frequently mentioned models were the AW139, AW169, Bell 412, EC145T2 and Sikorsky S-76 series. Emerging super-medium-class helicopters such as the AW189, Bell 525, and EC175 rely on large fleet operators in the energy, natural resource, and search and rescue sectors for substantial portions of their demand, and may be underrepresented in the current survey sample. Near-term interest may be volatile based on conditions in the energy markets.

- The light twin helicopter class earned between 18% and 19% of total operator purchase plans in the 2015 survey, with the EC135, Bell 429, and AW109 series helicopters noted most frequently.

- Heavy multi-engine helicopters, such as the EC225, AW101, and S-92, registered small but steady levels of new helicopter purchase plans in the 2015 survey; however, demand from large oil and gas fleet operators not included in the survey continues to support volume in the heavy class even though some near-term replacement activity may be deferred. Mi-8/17 purchase plans are not fully represented due to limited response from Russian operators in the 2015 survey.

This year's survey queried more than 1,000 chief pilots and flight department managers of companies operating 3,400 turbine and 400 piston helicopters worldwide. The survey excluded large fleet or "mega" operators, which were interviewed separately. Input received from large oil and gas support and emergency medical service fleet operators is factored into the overall outlook in addition to the individual flight department responses. The survey detailed the types of aircraft operated and assessed specific plans to replace or add to the fleet with new aircraft.

Source: Honeywell

Latest from Aerospace Manufacturing and Design

- The power of the plasma pen: Revolutionizing adhesion in aerospace manufacturing

- Mazak will show shops how to drive production at Dallas Open House

- Heavy-duty pneumatic flex locators

- Tacky Tape vacuum bag sealing tapes for aerospace composites continue a legacy

- Embraer’s Phenom 300 series is best-selling light jet for 14th consecutive year

- Expanded PushPull connector portfolio

- AEC is Meltio’s official sales partner

- Coolant-thru options for straight, 90-degree, universal live tools