The Equipment Leasing and Finance Association’s (ELFA) Monthly Leasing and Finance Index (MLFI-25), which reports economic activity for the $521 billion equipment finance sector, showed overall new business volume for June was $7.3 billion, up 33% from volume of $5.5 billion in the same period in 2010. Compared with May volume, June volume increased by 30%. Year to date, new business volume is up 28.5% over last year.

Credit quality is mixed. Receivables over 30 days decreased 14% to 2.5% in June from 2.9% in May, and declined by 24% compared to the same period in 2010. Charge-offs increased 38% in June from the previous month, and decreased by 35% from the same period in 2010.

Credit standards eased in June as the credit approvals ratio increased to 79% from 76% the previous month. Sixth-three percent of participating organizations reported submitting more transactions for approval during the month, a decrease from 68% in May.

Finally, total headcount for equipment finance companies in June showed no significant change month to month and year over year. Supplemental data shows that the construction and trucking sectors and small and medium-sized enterprises continued to lead the underperforming sectors.

Separately, the Equipment Leasing & Finance Foundation's Monthly Confidence Index (MCI-EFI) for July is 56.2, up 6.8% from the June index of 52.6. For more detailed information on the MCI-EFI visit www.LeaseFoundation.org

ELFA President and CEO William G. Sutton, CAE, says: “Overall new business activity in the equipment finance sector continues to show steady improvement in 2011. We hope this positive trend will continue as we head into the second half of the year amid an economic recovery restrained by uncertainty.”

Crit DeMent, Chief Executive Officer, LEAF Commercial Capital, Inc, located in Philadelphia, PA, says, “LEAF is experiencing similar results that are in line with the statistics detailed in the June MLFI index. We are receiving positive feedback from our equipment vendors that sales are beginning to trend upwards.” He added, “The majority of these sales are still replacement volume, which is driven by companies now obtaining new equipment they have been holding back on acquiring during the recession. The fulfillment of this pent-up demand is a positive indication that the economy is continuing to recover.”

Latest from Aerospace Manufacturing and Design

- The Lee Company opens Innovation Center

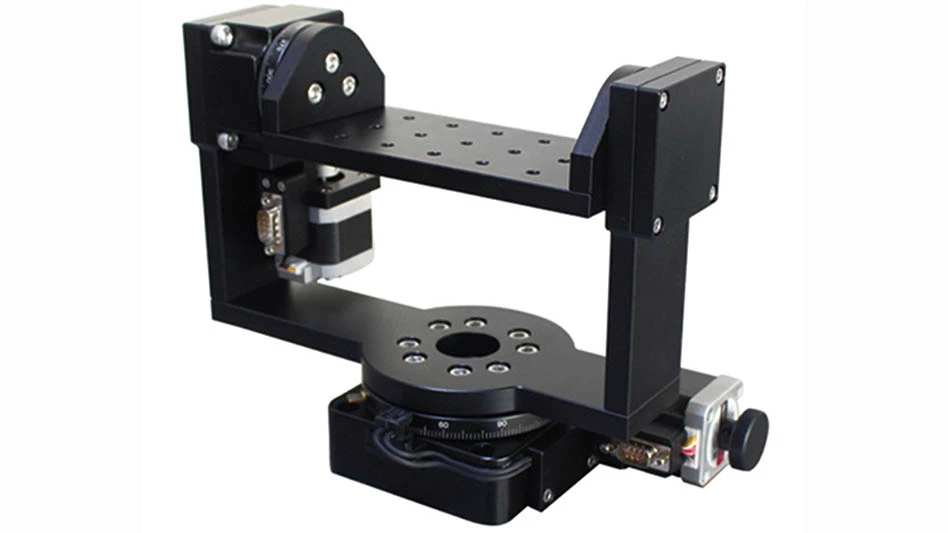

- Precision XY gantry system

- Archer to test Starlink onboard its Midnight air taxis

- System eliminates cage-creep in sliding bearings

- Bodo Möller Chemie signs worldwide supply contract with Airbus

- Sandvik Coromant's CoroTurn Plus turning adapter

- ZOLLER Technology Days & Smart Manufacturing Summit May 13-14, 2026 in Ann Arbor, Michigan

- Walter's TC620 Supreme multi-row thread mill family