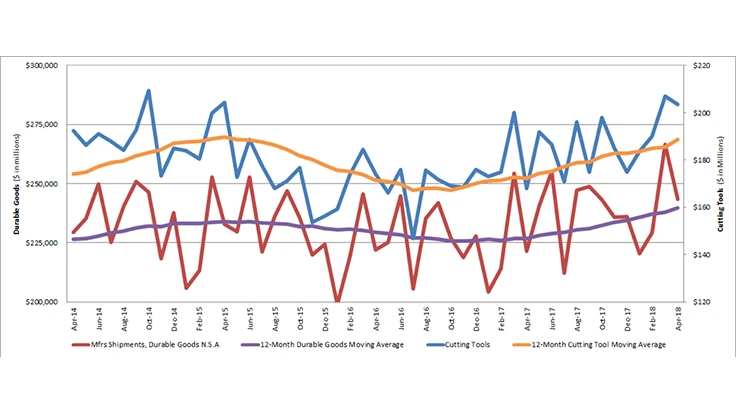

April U.S. cutting tool consumption totaled $203.68 million according to the U.S. Cutting Tool Institute (USCTI) and AMT – The Association For Manufacturing Technology. This total, as reported by companies participating in the Cutting Tool Market Report collaboration, was down 1.6% from March’s $207.08 million and up 21.2% when compared with the $168.03 million reported for April 2017. With a year-to-date total of $784.69 million, 2018 is up 9.6% when compared with 2017.

These numbers and all data in this report are based on the totals reported by the companies participating in the CTMR program. The totals here represent the majority of the U.S. market for cutting tools.

“April results trended down slightly, but that does not indicate the cutting tool market is softening. The year-over-year and year-to-date results reflect a very healthy market. Metal cutting shops have strong backlogs that will carry well into the future and the need for cutting tools will follow. Taking those much-needed summer vacations may be a challenge, but being busy is a good problem to have,” says Philip Kurtz, president of USCTI.

“After a solid start in 2018, year-to-date cutting tool shipments are nearly 10 percent above their 2017 levels. Growth in cutting tools is outpacing the solid momentum from the broader durable goods category, which has seen shipments rise 7% year to date. A 9% gain in year-to-date durable goods orders points to solid momentum in the second half of 2018,” says Gregory Daco, chief U.S. economist at Oxford Economics.

The Cutting Tool Market Report is jointly compiled by AMT and USCTI, two trade associations representing the development, production and distribution of cutting tool technology and products. It provides a monthly statement on U.S. manufacturers’ consumption of the primary consumable in the manufacturing process – the cutting tool. Analysis of cutting tool consumption is a leading indicator of both upturns and downturns in U.S. manufacturing activity, as it is a true measure of actual production levels.

Historical data for the Cutting Tool Market Report is available dating back to January 2012. This collaboration of AMT and USCTI is the first step in the two associations working together to promote and support U.S.-based manufacturers of cutting tool technology.

We have updated the graph to include the 12-month moving average for the Durable Goods shipments and Cutting Tool orders. These values are calculated by taking the average of the most recent 12 months and plotting them over time.

Latest from Aerospace Manufacturing and Design

- The power of the plasma pen: Revolutionizing adhesion in aerospace manufacturing

- Mazak will show shops how to drive production at Dallas Open House

- Heavy-duty pneumatic flex locators

- Tacky Tape vacuum bag sealing tapes for aerospace composites continue a legacy

- Embraer’s Phenom 300 series is best-selling light jet for 14th consecutive year

- Expanded PushPull connector portfolio

- AEC is Meltio’s official sales partner

- Coolant-thru options for straight, 90-degree, universal live tools