Excellent fundamentals

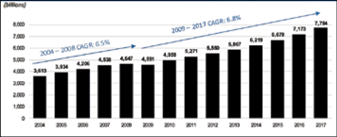

The aerospace sector is experiencing an unprecedented expansion. Air travel demand, defined as revenue passenger kilometers (RPKs), has steadily increased and growth is accelerating. After sprinting from 3.6 billion RPKs to 4.6 billion RPKs from 2004 to 2008, travel declined 1.2% during the Great Recession. The market quickly compensated for this decline, returning to robust growth with a compounded annual growth rate (CAGR) of 6.8% from 2009 to 2017. Moreover, this growth has continued to accelerate from 2014 to 2017, reaching 7.6%. Strong demand has translated into sustainable growth.

Because of these exceptional growth rates, demand has led to record backlogs for Airbus and Boeing. At current production rates, they have eight years of backlog. Although Boeing experienced a slight decline in its backlog from 2009 to 2014, the combined backlog continued to expand from 2014 to 2017.

Boeing has increased its B-737 production from 35 aircraft per month in 2012 to 52 aircraft per month in 2018, with the expectation of increasing production by another five planes per month in 2019. Airbus is increasing A320 production from a rate of 50 aircraft per month in 2017 to 60 aircraft in 2019. If both manufacturers meet their 2019 targets, narrow-body production will have

Valuation and performance

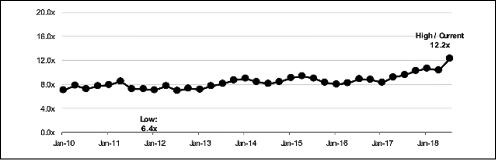

Strong fundamentals have driven public aerospace valuations to near all-time highs. Publicly-traded aerospace companies have sharply outperformed the S&P 500 during the past 10 years.

Relative valuations have almost doubled, with public aerospace companies trading at an average of 12.2x forward earnings before interest, tax, depreciation, and amortization (EBITDA). Public aerospace companies’ valuations are well above historical levels and nearly double their late 2011 lows (see Chart 1).

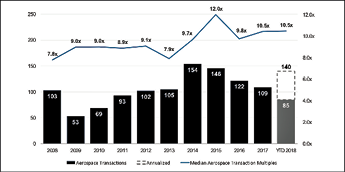

Accelerating deal volume

M&A valuations and annual transactions are above recent historical averages. At 10.5x last twelve months (LTM) EBITDA, valuations for the aerospace sector are above the historical average. Although deal volume declined from 2014 to 2017, the number of transactions closed in 2017 remained higher than the 10-year average. More importantly, if the pace of deals during the first seven months of 2018 is extrapolated throughout the year, 2018 should significantly exceed the number of deals closed in 2017 (see Chart 2).

Deals re-shaping the market

The leading aircraft original equipment manufacturers (OEMs) and Tier 1 suppliers are significantly altering the competitive landscape. With the Embraer joint venture, Boeing expands its position within the narrow-body aircraft category and becomes a leader within the regional jet market. Boeing also acquired KLX in May 2018 to expand its presence in supply chain management, building upon its acquisition of Aviall in 2006. The Airbus tie-up with Bombardier on the C-Series was a catalyst for bringing about the Boeing/Embraer joint venture. Of course, Airbus gained control of the C-Series aircraft without making a cash investment.

United Technologies Corp. (UTC), as well as Safran, are consolidating Tier 1 suppliers with the purchases of Rockwell Collins and Zodiac Aerospace, respectively. Spirit

The aerospace market is undergoing a critical transformation that emphasizes

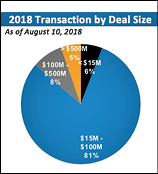

Middle-market sweet spot

Although large deals receive most of the headlines, the middle market continues to lead M&A deal volume, with 95% of deals in the aerospace and defense sector at less than $500 million each (pie chart, right).

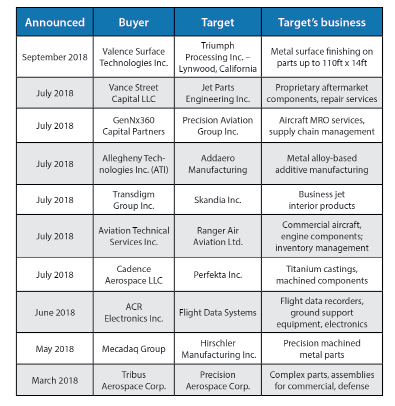

Middle-market consolidation

Ten deals from the past several months show companies deploying a buy-and-build strategy (see Chart 3). Eight of the deals were financed by private equity groups and include metal processing and precision machining manufacturers; maintenance, repair, and overhaul (MRO) providers; and aircraft interiors manufacturers. No matter the sub-sector, there is a group of acquirers aiming to consolidate the market.

Industry actively acquiring

Private equity (PE) groups and their portfolio companies are actively acquiring aerospace and defense (A&D) businesses – PE involvement represents almost 40% of A&D deal activity. Many groups are serial acquirers with multiple interests. The most active PE firms in the sector include Acorn Growth Companies, AE Industrial Partners, Arlington Capital, and Liberty Hall Partners, while groups such as Blackstone, The Carlyle Group, GenNx360, JLL Partners, and

However, strategic operators are not ready to be outdone by PE firms. In 2017, UTC acquired Rockwell Collins, itself among the more active acquirers of aerospace companies. The market also witnessed European aerostructures companies, such as Sonaca and Aernnova, purchase U.S. firms to expand their presence with Boeing. Transdigm has remained aggressive in the space, recently adding Skandia to its portfolio, as it continues to acquire approximately three companies annually. Other key acquirers in the sector include AAR Corp., CIRCOR, Curtiss Wright, Ducommun, HEICO, Heroux-Devtek, and L-3 Technologies. These strategic buyers actively use M&A to acquire new customers and capabilities, while also improving their relative importance within the supply chain.

Optimism about the future

The KippsDeSanto 2018 M&A Survey has several interesting findings regarding market optimism. Generally, respondents expressed a favorable sentiment about the U.S. economy, M&A activity in the commercial aerospace sector, and the stability and growth of the commercial aerospace market.

- 95% of respondents are optimistic about U.S. economic growth

- 98% expect aerospace M&A activity to remain the same as 2017 or increase by more than 5%

- 82% anticipate a stable or growing commercial aerospace market; 5% of the respondents indicated that the commercial aerospace market is no longer cyclical, noting; “Cycle? What cycle? Cycles are dead.”

Not surprisingly, given

An opportunity to maximize value

The current market affords shareholders and owners a great opportunity to maximize value. The fundamentals are excellent and have led to record valuations. The velocity of transactions has remained robust and recent indicators suggest this may accelerate. Consolidation among Tier 1 suppliers is occurring at a quick pace, in turn, putting more pressure on the supply base to consolidate. Consequently, middle-market deals are the most active segment of the market and are supported by significant interest from both private equity firms and strategic operators alike. Among strategic acquirers, both domestic and international buyers remain active. In summary, all M&A signals lead to positive trends for the aerospace industry.

KippsDeSanto & Co.

https://kippsdesanto.com

Explore the October 2018 Issue

Check out more from this issue and find you next story to read.

Latest from Aerospace Manufacturing and Design

- US operator UrbanLink orders 20 Lilium Jets

- TJ Davies’ retention knobs

- Mazak's VC-Ez 16X for aerospace machining

- India’s IndiGo orders 30 Airbus A350 widebody aircraft

- Techman Robot unveils high-payload AI cobot TM30S at Automate

- MK Tools’ 4-fluted Rambo Speed Drill series solid carbide drills

- ASL orders 30 Reliable Robotics aircraft autonomy systems

- Fastems' Manufacturing Management Software Version 8.2