Editor's Note: This article originally appeared in the January/February 2026 print edition of Aerospace Manufacturing and Design under the headline “2026 Forecast.”

CREDIT: ADOBE STOCK | © mschauer

Global demand for air travel remains strong. The International Air Transport Association (IATA), the world’s airline trade association, projects global passenger traffic will reach a record 5.2 billion passengers in 2026, growing around 4.4% to 4.9% from 2025.

Airlines continue to order jetliners. By the end of 2025, Boeing collected 1,167 gross orders, led by 591 orders for 737s and a rebound in demand for the widebody 787 with 381 orders. This past year for the first time since 2018 Boeing surpassed Airbus, which had 1,000 gross orders, with A320neo family single-aisle jets accounting for 656 orders, followed by 193 twin-aisle A350 orders.

Forecast Int’l calculates Airbus and Boeing had a combined backlog of 15,461 commercial aircraft. At current build rates, the backlog would take each original equipment manufacturer (OEM) more than 11 years to deliver.

The continuing aircraft production backlogs are causing airlines to fly existing fleets longer and invest more in reliability, availability, and maintainability, according to Deloitte’s 2026 Aerospace and Defense Industry Outlook. That translates to continued strong maintenance, repair, and overhaul (MRO) demand.

Global aviation marketplace locatory.com estimates the global engine MRO market in North America is valued at $137 billion from 2025 to 2034.

CFM Int’l deliveries of LEAP engines for 737s and A320s through the first nine months of 2025 were up 21% compared with 2024. LEAP engines account for nearly three-fourths of narrowbody engines. Pratt & Whitney supplied enough engines to meet its share of aircraft OEMs’ 2025 production and was delivering engines for 2026 production ahead of schedule. Pratt & Whitney’s Geared Turbofan backlog exceeded 12,000 engines by mid-2025.

Commercial aircraft manufacturers are beginning to resolve supply chain constraints that have thwarted efforts to increase production rates. Notable in 2025, Boeing and Airbus each absorbed the aerostructures production that had been provided to both by Spirit AeroSystems

Quality issues popped up in the form of a software recall for 6,000 Airbus A320 family jets due to solar flare vulnerability. Metal panels near the cockpit were the wrong thickness on some A320s due to what the plane maker characterized as a “supplier quality issue” requiring hundreds of inspections and a reduction in delivery goals. And contaminated powdered metal in high-pressure turbine and compressor disks was causing microscopic cracks and potential failures on about 3,000 Pratt & Whitney engines manufactured between 2015 and 2021 powering Airbus A320neo and some A220 aircraft.

Production rates climbed modestly in 2025, with Deloitte’s 2026 aerospace and defense (A&D) outlook stating, “the commercial aerospace sector appears poised to continue growth, aided by rising fleet utilization, continued fleet growth, and steady gains in both passenger and cargo demand.” The report cites five trends likely to shape the industry this year: Artificial intelligence (AI) and agentic AI; reshaping of the MRO aftermarket; building supply chain resiliency and efficiency amid volatility; unlocking competitive advantage in contracting and procurement; AI driving workforce transformation by shifting from big data to multidisciplinary skill sets. https://www.deloitte.com https://www.forecastinternational.com https://www.iata.org

First flight of the second A321XLR test aircraft. CREDIT: AIRBUS SAS AIRBUS delivered 793 commercial aircraft to 91 customers globally in 2025 and registered 1,000 new gross orders in the commercial aircraft business. The backlog at the end of December 2025 increased to a new year-end record of 8,754 aircraft, up from 2024’s year-end backlog of 8,658 aircraft. Widebody backlog reached a year-end record of 1,124 aircraft.

Despite what a company’s year-end summary called “a continued complex and dynamic operating environment,” deliveries in 2025 continued an upward trajectory.

In the first two days of the 2025 Paris Airshow, Airbus obtained or finalized agreements for 180 widebody and narrowbody commercial jetliners. If further options are exercised, the total could reach 288.

Airbus’ U.S. manufacturing facility in Mobile, Alabama inaugurated its second A320 final assembly line in October, with the facility tripling in size since Airbus started manufacturing commercial aircraft in the U.S. in 2015. https://www.airbus.com

Airbus commercial aircraft deliveries 2025 vs. 2024 Program 2025 2024 A220 family 93 75 A320 family 607 602 A330 family 36 32 A350 family 57 57 Total 793 766

Qatar Airways placed a record setting order for Boeing widebodies last May. PHOTO CREDIT: BOEING BOEING ’s backlog totaled 6,713 aircraft at the end of 2025. The company jointly agreed with the FAA in October to increase 737 build rates from 38 to 42 per month. Long-term, the goal is 52 narrowbodies per month. For 787s, production was seven per month in November with a goal of 10 per month in 2026.

Qatar Airways’ agreement to purchase 130 787 Dreamliners and 30 777X airplanes set a record as Boeing’s largest widebody order. An additional 50 787 and 777X airplanes are an option.

In 2025, Boeing Defense, Space & Security Programs delivered 131 new-build production units, including remanufactures and modifications of helicopters, fighters, tankers, patrol, trainers, and satellites – up from 112 in 2024. https://www.boeing.com

Boeing commercial aircraft deliveries 2025 vs. 2024 Program 2025 2024 737 447 265 767 30 18 777 35 14 787 88 51 Total 600 348

Embraer’s Phenom 300E, light-jet market leader. PHOTO: EMBRAER EMBRAER delivered a total of 244 aircraft across Commercial Aviation, Executive Aviation, and Defense & Security divisions in 2025, surpassing the 206 units delivered in 2024. Commercial Aviation delivered 78 jets (34 E175, 6 E190-E2, and 38 E195-E2), in-line with its 77-to-85 aircraft guidance for the year. Executive Aviation delivered 155 jets in 2025, at the high end of its 145-to-155 guidance for the year. Phenom light jets numbered 86, mid-size Praetor jets, 69. The Phenom 300, the light jet market leader for 13 consecutive years, accounted for 72 deliveries. Defense & Security delivered three C-390 Millennium military transport planes in 2025, the same as the year before. It delivered eight A-29 Super Tucano tactical aircraft.

As of the end of Q3 2025, Embraer’s order backlog reached $31.3 billion, an all-time high for the company. https://embraer.com

Lockheed Martin celebrated the roll-out of the first F-35A for the Finnish Air Force in December. PHOTO CREDIT: LOCKHEED MARTIN LOCKHEED MARTIN delivered 191 F-35 Lightning II joint strike fighter aircraft in 2025, surpassing the previous delivery record of 142 stealth jets. The program also reached one million flight hours earlier in the year and the program team completed delivery of the TR-3 advanced software update.

In September, the F-35 Joint Program Office (JPO) and Lockheed Martin reached final agreement of Lots 18-19 for the production and delivery of up to 296 F-35s for $24 billion, finalizing the largest production contracts in program history. The JPO and Lockheed Martin also agreed to an Air Vehicle Sustainment Contract award supporting annualized sustainment activities across the F-35 enterprise for 2025 and beyond.

Internationally, Italy added 25 F-35s and Denmark 16 F-35s to their fleets, Finland celebrated the rollout of its first F-35, Belgium welcomed its first in-country aircraft, and Norway completed deliveries to its F-35 fleet – becoming the first F-35 partner nation to receive all aircraft (52) in its program of record. Twelve nations now operate the F-35, with almost 1,300 aircraft in service. https://www.f35.com https://www.lockheedmartin.com

THE GLOBAL SPACE ECONOMY for 2024/2025 was worth $613 billion, up more than 7.5% from $570 billion the previous year, the Space Foundation reports. Around 78% of the value was driven by commercial activities, with government budgets contributing the remaining 22%. The U.S. government invested $77 billion in national security and civil space programs during the period. The upward trend is expected to continue, with the space market estimated to reach $1.8 trillion by 2035. https://www.spacefoundation.org

INDUSTRY INSIDERS Richard Aboulafia, FRAeS, Managing Director, AeroDynamic Advisory The clearest aerospace trend that will continue in 2026 is a strange combination of strong markets and uncertain production. Demand remains quite robust for jetliners, military aircraft, and business jets, but output is another story.

Overall, deliveries expanded in 2025 by double-digits in value, but much of this was driven by Boeing’s recovery from its 53-day strike in 2024 (although Boeing also successfully increased its monthly output rates). Military growth was driven by the deliveries of scores of F-35s that had already been built but were awaiting software modification under the Block 4 update program.

Airbus was the one big producer not impacted by either of these factors. Tellingly, Airbus deliveries only grew by around 2% by value. That might be an accurate reflection of the state of play in aircraft supply chains. The question is how quickly bottlenecks can be circumvented and market demand can be satisfied.

One somewhat related trend is efforts by new producers to enter the industry. After many decades of very high barriers to market entry, the past few years have seen a veritable horde of new civil and military companies aspiring to join the club of aerospace producers. These include new U.S. tech defense companies (such as Anduril and Shield AI), new advanced air mobility companies offering a variety of new civil platforms (such as Joby, Boom, and JetZero), and emerging national defense champions (such as Korea Aerospace, Turkish Aerospace, and Hindustan Aeronautics). Most of these have been established for years but have been given new relevance by the global drive toward defense sovereignty. For all these emerging producers, this will be a telling year for their ability to deliver on big promises.

If all goes as planned, in 2026 we’ll see strong growth, and a larger number of industry players. But then again, 2025 shows us that all generally doesn’t go as planned. https://aerodynamicadvisory.com

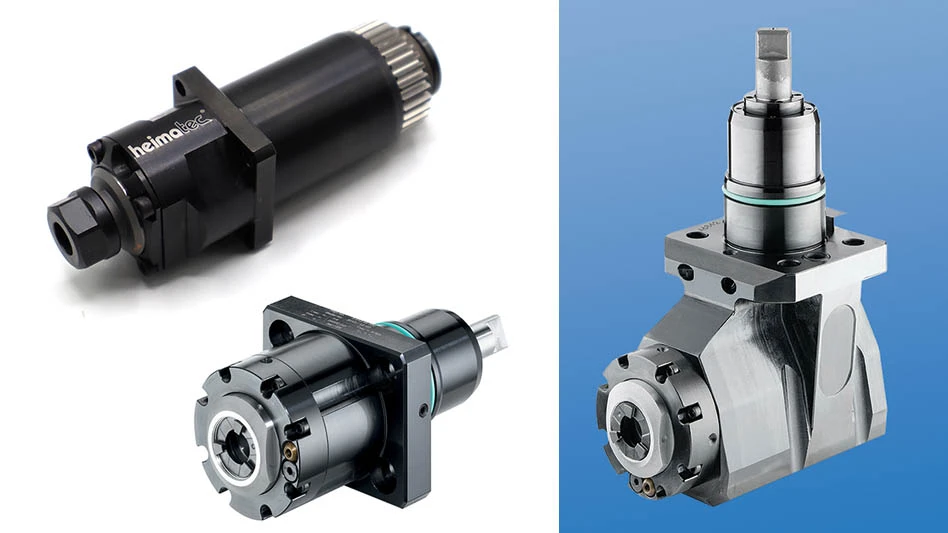

Russ Reinhart, National Sales Manager, Lyndex-Nikken In 2026, aerospace manufacturers face a critical inflection point. While orders remain healthy in many segments, the economic uncertainty and capital constraints are forcing machine shops to rethink their approach to capacity expansion. The question is no longer just “how do we grow?” but “how do we do more with what we already have?”

Across the aerospace supply chain, manufacturers are grappling with a common challenge: meeting increased demand without major capital expenditures.

Rather than investing in additional machines, forward-thinking aerospace manufacturers are turning to proven technologies that unlock hidden capacity in their existing equipment:

Tool presetters: Customers who implement preset tooling systems consistently report significant improvements in setup time and first-part accuracy.SK collet chuck technology: High-precision collet chucks are not just an alternative to standard holders; they are a necessary component for achieving the demanding specifications of aerospace contracts.Zero-point clamping has emerged as a game-changer for shops running complex, low-to-medium volume aerospace componentsCNC rotary tables expand machining capacity by adding a 4th or 5th axis to existing machine tools.In 2026’s economic environment, capital efficiency is the new capacity expansion. Aerospace manufacturers who invest in technologies that multiply the productivity of their existing equipment will be better positioned than those who only add more machines to the floor. https://www.lyndexnikken.com

Dave Bersaglini, President, Metal Cutting, Kennametal Aerospace innovation is accelerating, but manufacturing constraints are tightening – creating a widening paradox between what engineering imagines and what production can reliably deliver. Designers push performance with advanced composites, titanium, and heat-resistant superalloys (HRSAs), while factories face pressure to increase output, hold quality, and manage complexity at scale.

That gap is fundamentally a materials problem. Modern airframes and propulsion depend on alloys optimized for strength, temperature tolerance, and weight – not machinability. Those same properties generate extreme cutting forces, concentrated heat, and rapid tool wear, with downstream impacts on cycle time, capacity, and part integrity. Heat-resistant superalloys often machine 4x to 5x slower than steel, compounding bottlenecks.

Machining isn’t a tooling issue; it’s a physics issue. Cutting dynamics, heat flow, chip evacuation, and tool stability define process capability long before a part reaches the spindle. Treating cutting tools as interchangeable commodities in this environment undermines productivity and predictability.

Leading manufacturers are responding with collaborative, application-driven engineering models. Tool geometry, carbide substrate, and coatings are engineered together around specific materials and operations, with chip evacuation, thermal control, and stability as core requirements. Behaviors that matter on the floor – chatter suppression, harmonic control, consistent load distribution, and edge integrity under thermal extremes – are designed in, not hoped for.

Application-specific solutions such as Kennametal’s HARVI II TE solid carbide end mills enable faster removal in titanium structures and longer, more stable tool life in HRSA engine parts. The advantage is clear: significant cycle-time reductions and measurable gains in tool life, fewer defects, and production systems aligned with next-generation aerospace performance. https://kennametal.com/us/en/industries/aerospace.html

Dan Cleary, President, Mitsui Seiki USA Credibility, partnering, and long-term strategic planning will be the keys to successful high-precision operations in 2026.

Tariffs have permanently changed how manufacturers think about capital investment. Early uncertainty caused many shops to delay purchases unless they were absolutely necessary. Today, tariffs are no longer a political discussion inside a shop, they are a math problem. From my perspective, tariffs influence buying behavior far more than machining behavior. Shops are still running hard. What has changed is how cautious, deliberate, and ROI-driven equipment decisions have become. The companies that manage tariffs best treat them like freight, financing, and installation costs. They plan early, negotiate intelligently, and align purchases with real programs. The most stable customers accept the cost, engineer around it, and focus on long-term productivity instead of short-term sticker shock.

Aerospace and defense demand remains strong but disciplined. Military and defense programs are solid and predictable, rewarding suppliers who invest correctly and execute consistently. Commercial aerospace demand is also healthy, but OEMs are prioritizing supply chain reliability, quality, and repeatability over aggressive rate increases. Expectations have shifted. OEMs increasingly expect suppliers to operate as extensions of their own factories. That means tighter tolerances, stronger documentation, better process control, and machines capable of running accurately for long periods of time without constant oversight. Shops should expect more scrutiny, greater accountability, and less tolerance for excuses.

Automation is no longer about headcount reduction or marketing optics. It’s about survival and scalability. High-precision machining without automation is becoming difficult to justify economically, especially in aerospace. The trend is toward flexible, modular automation rather than large custom systems. Palletization, probing, tool management, and thermal control working together as a system are delivering the real gains. Automation does not replace skill, it reallocates it. The best shops use automation to free their most capable people to focus on process development and continuous improvement.

Additive manufacturing (AM) continues to gain attention, but expectations are realistic. Additive is a complement to precision machining, not a replacement. As additive grows, the need for accurate finishing, alignment, and geometry control increases.

High-precision machining is foundational. Precision today means repeatability over time, thermal stability, structural integrity, and control over variation. You can’t automate or run lights-out without it. Discipline and long-term thinking will define the leaders in the years ahead. https://www.mitsuiseiki.com

John Giraldo, Americas Engineering Projects Manager, Aerospace, Space and Defense, Sandvik Coromant Aerospace manufacturing is entering a period where small shifts in technology and process control are starting to add up to bigger gains. As we look toward 2026, three areas stand out.

The first is the machinability of advanced materials. As heat-resistant superalloy (HRSA) materials become even more common in aero engines and structural components, manufacturers are looking for ways to keep heat in check without slowing throughput. We’re seeing more shops move toward high-pressure, through-tool coolant and refined chip-breaking strategies, because they offer better stability, protect tool edges, and improve surface integrity in complex profiles.

Automation is also becoming more practical, not just possible. Instead of large, fully automated cells, many aerospace suppliers are adopting smaller, modular setups that help them run lights-out when appropriate and increase spindle utilization during the day. The focus is shifting from “automate everything” to “automate what matters,” especially around repetitive operations in titanium, stainless steel, and composites.

The third trend is data-driven decision-making at the machine level. Shops want clearer insights into tool life, cutting behavior, and process efficiency, but they need it delivered in a way that fits into their existing workflows. Lightweight digital tools connecting operators, programmers, and automation in real time are gaining traction, because they reduce variability and help teams respond faster to changes in material conditions.

Together, these trends point toward a 2026 where precision, predictability, and smarter use of technology define success for aerospace manufacturers. https://www.sandvik.coromant.com

Scott Thompson, PwC Global Aerospace & Defense Leader Aerospace and defense (A&D) is facing one of its most consequential transitions in decades. PwC’s recent aerospace and defense report, 10 moves to position growth in 2026 , shows commercial aerospace carrying a backlog of roughly 14,000 aircraft, equivalent to more than 10 years of production at current rates. That level of demand underscores the strength of the market, but it also highlights why improving production rhythms will be essential in 2026.

Defense demand is also reshaping portfolios. Backlogs and modernization programs continue to grow as nations respond to evolving security environments, creating persistent demand for advanced capabilities including space systems, autonomy, and resilient mission software.

Securing sovereign supply chains has become a strategic imperative, not only for resilience, but for national security. And it is not exclusive to A&D. Securing sovereignty across the entire economy is critical to national security – food, water, energy, healthcare, infrastructure and finance. PwC’s Future of Industrials survey found that about 45% of A&D executives expect to reshore or nearshore most production by 2030, and 26% are investing in redundant system failover as a self-healing supply chain capability. This reflects a broader industry shift toward diversified networks and stronger end-to-end visibility, which will be a competitive differentiator in 2026.

Workforce challenges are also intensifying, with aging teams and too few early-career employees slowing execution. Organizations that accelerate recruiting, apprenticeships, and upskilling will be better positioned to meet both commercial and defense demand.

Three themes stand out for 2026: execution at scale, supply chain sovereignty, and digital-enabled growth. Companies that invest in digital transformation, build resilient supply networks, and align their talent strategy with long-term demand will outperform. Strong demand alone won’t be enough unless it is matched with capability and execution.” https://www.pwc.com

Henning Dransfeld, Director of Strategy of Industry & Solutions (Aerospace & Defense), Infor As we enter 2026, the pressure on agility and scale is increasing, and success will depend on how effectively organizations can build resilience into every stage of operations, from design and production to supplier collaboration and long-term program support.

Insight-driven decision making: Aerospace manufacturers are embracing real-time, predictive operations that anticipate disruptions before they escalate. Live analytics, digital twins, and advanced monitoring systems are turning factories into intelligent ecosystems where teams can act decisively to protect schedules and keep programs on budget.

Safeguarding intellectual property for multi-decade programs: Leading A&D manufacturers are rethinking how they preserve and share knowledge across program life cycles. Cloud-based collaboration platforms serve as secure, living archives that capture decisions, design rationales, and compliance documentation as they happen. These environments also provide full traceability for certifications, version histories, and engineering changes, ensuring no detail is lost even as teams transition. A crucial asset is the capability to make knowledge accessible across geographies and generations, connecting design engineers, production partners, and maintenance crews with a single, trusted source of truth.

Cybersecurity as reliability: With CMMC 2.0 coming into force, a single vulnerability in a supplier’s shared portal or a production line’s digital control system can affect the entire program.

Leading manufacturers are embedding cyber resilience into the very fabric of their operations: from CAD and PLM systems to manufacturing execution and supplier collaboration platforms. Organizations must assure their customers and partners that every digital connection is dependable.

Cloud-native platforms drive innovation: Industry-specific, cloud-native platforms provide real-time visibility into everything from component sourcing to production line performance, allowing teams to make rapid design adjustments and respond instantly to shifting customer or regulatory demands.

Embedded AI capabilities help identify performance anomalies before they become quality issues, while digital threads ensure traceability from concept to maintenance. Automated compliance tools reduce the administrative burden of documentation and audits. The organizations that master this integration of technology and process are well equipped to innovate with confidence, even amid the uncertainty of global supply chain volatility.

Operational resilience will define the standard: In 2026, operational resilience has become the defining measure of competitiveness in aerospace and defense manufacturing. Companies that emerge as leaders in the forthcoming years weave resilience into their operations, combining predictive analytics, knowledge preservation, and cybersecurity within intelligent, cloud-based ecosystems. This holistic approach enables them to anticipate and withstand disruption, turning complexity into control and volatility into opportunity. https://www.infor.com/industries/aerospace-defense

Paul Bottiglio , Senior VP & CFO, Commercial Credit Group Inc.As we look at 2026, manufacturers and CNC machine tool purchasers face a landscape shaped by economic uncertainty, evolving technology, and workforce challenges. At Manufacturers Capital , a division of Commercial Credit Group Inc., we see several trends that will influence purchasing and financing decisions in the coming year.

Tariffs and pricing pressures – Tariffs continue to drive up the cost of raw materials and imported machinery. For equipment buyers, this means higher upfront prices and a greater need for strategic financing. Establishing an equity position from the start is critical. This not only strengthens your balance sheet but also positions you for long-term success when your needs or market conditions shift.

Rising demand for used equipment – As new equipment prices climb, demand for used machinery is increasing. While purchasing used equipment can offer cost savings and immediate availability, it also underscores the importance of working with lenders who understand the nuances of equipment valuation, lifecycle and how it fits with your business strategy.

Labor and automation – Manufacturers are grappling with a shortage of skilled labor, and automation is accelerating to fill the gap. This shift requires workers with new technical skills, creating both opportunities and challenges for businesses investing in advanced manufacturing and CNC technology.

Interest rates and market dynamics – While interest rate changes and Fed policy have a modest direct impact on financing costs, their ripple effects across the economy can significantly stimulate demand for manufacturing activity. Staying attuned to these macroeconomic signals is essential for strategic planning.

Industry-specific financing expertise – Finally, we anticipate growing demand for lenders who truly understand the borrower’s industry and equipment and remain nimble in an evolving landscape. In a complex environment, expertise matters, both in structuring deals and in supporting long-term growth.

As 2026 unfolds, proactive planning and informed financing decisions will be key to thriving in a market defined by volatility and innovation. https://www.commercialcreditgroup.com/industries/manufacturing-equipment-financing

Jason Roberson, Industry Value Expert, Aerospace & Defense at Dassault Systèmes AI will become the operating system of space: AI has already launched the next era of space innovation, but the year ahead will see it embedded into almost every layer of the ecosystem, powering everything from spacecraft design and manufacturing on Earth to autonomous servicing and traffic management in orbit. In this new era, AI infrastructure for space will continue to expand to enable AI as both the brains and the blueprints of space, guiding satellites in orbit, optimizing how we build them, and teaching humans how to better repair or operate them remotely. We are at the beginning of true autonomous space operations, where intelligent systems make real-time decisions faster and safer than humans can.

Operating closer to Earth. Very Low Earth Orbit (VLEO) continues to emerge as a competitive frontier in space. With launch costs continuing to fall and satellite design becoming more modular and autonomous, companies are moving closer to Earth to gain an edge in speed, resolution, and responsiveness. Unlike traditional low Earth orbit (LEO) satellites, VLEO platforms promise ultra-low latency, sharper imaging, and faster data delivery, which will advance markets such as 5G connectivity, climate intelligence, and national security.

Orbital innovation will shape our future in 2026. Across Low Earth Orbit (LEO), we’re testing and refining the very technologies that will make sustained life in space possible. From manufacturing semiconductors and pharmaceuticals in microgravity, to experimenting with tissue growth and running early-stage data centers off-planet, the groundwork is actively being laid. https://www.3ds.com/industries/aerospace-defense/space

Jeff White, Manufacturing Law and Aerospace Supply Leader, Robinson+Cole 2025 was a year of uncertainty for aerospace manufacturers. There was growth and there were disruptions in the United States and globally. We live in an era of uncertainty; yet when evaluating legal and commercial trends for 2026 there are certain things that we can bank on.

Tariffs are here to stay. Regardless of what the U.S. Supreme Court decides as to the legality of the reciprocal tariffs and regardless of trade agreements that may be reached with specific countries, there’s no indication the current administration will return to a low tariff environment. The aerospace industry will continue to be impacted by Section 232 steel and aluminum tariffs, as well as other tariffs. We’ve worked with many manufacturers to mitigate their tariff exposure through various means and that will continue.

Industry consolidation will continue. In an era of vertical integration and private equity acquisitions and roll-ups, there will be no shortage of transactions to enhance scale.

Not every transaction will be large. The mergers and acquisition (M&A) market for small to midsize manufacturers will remain hot. Many are looking for the next company to buy – many hoping without an auction.

The workforce shortage remains a huge challenge. Some aerospace manufacturers focus entirely on automation while others search for the next generation of workers. Either way, manufacturers must continue ramping up their efforts to recruit and retain workers. Similarly, teaming agreements, where two manufacturers partner and bid on a larger contract, will continue to be popular.

Everyone still wants a repair station . The interest in maintenance, repair, and overhaul (MRO) will not dissipate in 2026. https://www.linkedin.com/in/jeff-white-9937676

Hari Kumar Rajendran, Executive Vice President, Global Warehouse Operations, Incora In 2026, the aerospace and defense sectors are entering a period of synchronized global expansion marked by modernization, digitization, and resilience-building across the supply chain. The geopolitical climate continues to drive investment, but equally important is how the industry is responding: through smarter infrastructure, tighter partnerships, and accelerating adoption of artificial intelligence (AI) and automation.

Across North America, the U.S. remains the world’s largest single aerospace and defense market, but growth is being shaped as much by digital transformation as by budget size. The U.S. Department of War’s upcoming Joint Warfighting Cloud Capability (JWCC) contract, valued at $10 billion, will replace the earlier JEDI initiative and serve as a foundation for data-driven military modernization. Migrating vast data ecosystems to the cloud will fast-track the deployment of AI across logistics, maintenance, and command systems, creating ripple effects for the entire aerospace supply chain.

In Europe, the Middle East, and Africa (EMEA), heightened NATO commitments and evolving U.S. policy have sparked renewed investment in both commercial and defense programs. However, regional sourcing and regulatory compliance remain critical for companies seeking to secure business in these markets. Local production capacity, transparent supplier networks, and sustainable logistics strategies are now as decisive as price or performance.

Meanwhile, Asia-Pacific continues to post high single-digit growth, with countries such as Japan, South Korea, and Australia expanding aerospace and defense manufacturing footprints. Indigenous sustainment and digital integration, especially around AI-enabled systems, will define the region’s competitiveness.

Globally, the supply chain story of 2026 is one of acceleration, adaptation, and innovation. Aerospace manufacturers and distributors are rethinking how goods, data, and intelligence move through networks. From advanced warehouse automation to predictive analytics, the industry’s collective goal is clear: build the flexibility to meet rising demand while embedding resilience deep into every layer of the global aerospace ecosystem. https://www.incora.com

Luis Gomez, Group President, The Partner Companies In 2026, artificial intelligence (AI) and predictive maintenance represent an opportunity to further strengthen efficiency and overall productivity.

Predictive maintenance has the potential to move from reactive to condition-based decision-making. By analyzing machine data such as utilization, temperature and cycle-time trends, AI can identify indicators of wear or failure before issues impact production or quality.

The greatest value lies in applying these capabilities to CNC assets, tooling, and quality processes. AI-driven insights could help reduce unplanned downtime, improve first-pass yield, and meet tight aerospace tolerances and delivery commitments. Although this will take time to adapt, it’s vital to stay ahead of competitors and meet customers' expectations.

As the industry evolves, AI is likely to become an integral part of how leading manufacturers manage risk, protect critical assets, and deliver consistent performance to their customers.

Across aerospace and precision manufacturing, companies are rethinking workforce models. The discussion is shifting away from whether AI will replace people to how it can better support them. AI will help companies augment experience, reduce variability, and make institutional knowledge more durable and sustainable.

Rather than relying on a small number of individuals to sense when something is off, data and AI can provide earlier signals and consistent insights. This creates a stable operating environment that reduces risk as organizations scale or experience workforce turnover.

The future workforce is not about fewer people, but better-enabled ones. Organizations that align technology adoption with workforce development will build long-term resilient, scalable, and competitive operations. https://www.thepartnercos.com

Jeff Schemel, General Manager USA and Canada, REGO-FIX The demand for aviation maintenance, repair, and overhaul (MRO) operations looks positive over the next five years as aerospace manufacturers struggle to meet new aircraft airframe quotas, forcing airlines to fly aging fleets. The sector will not be without its challenges, however, meaning MRO shops must capitalize on every opportunity from automation to advanced tooling and processes to maintain efficiency and cost-effective production.

Airline fleets continue to age with each passing year. Commercial planes in North America’s big three – United, Delta and American – are on average just under 16 years old, according to numbers from civil aviation database Plansespotters.net, and the global fleet average age is just over 13 years.

With an airframe lifespan of between 25 and 35 years – depending upon flight hours and pressurization cycles – the current global commercial air fleet has plenty of remaining flight time, and MRO operations are projected to increase to keep planes airworthy. Industry watchers say the MRO market generated $114 billion in 2024, about a 7% increase from its pre-COVID peak in 2019. The sector is expected to a grow at a rate of 2.7% annually through 2035 and tally $156 billion in revenue.

To fully capitalize on that growth potential, MRO shops must exploit emerging Industry 4.0 technologies such as connectivity, the power of big data and artificial intelligence (AI) to make the most of what’s to come. Equally important, advanced precision cutting tools and toolholders along with automated toolcribs will make high-performance aircraft component processing more efficient.

Increased MRO operations are a certainty in aerospace manufacturing’s near-term future. Premium tooling and toolholding systems along with toolcrib automation are two strategies that will help MRO shops capitalize on the coming opportunities. https://regousa.com

Nilopal Ojha, Associate Manager – Aerospace & Defense, MarketsandMarkets The use of artificial intelligence (AI) in predictive and prescriptive analytics is simultaneously transforming the aviation industry into a data-driven and condition-aware field. This shift is most evident in maintenance, where predictive maintenance enables airlines to anticipate component failures before they occur. This capability dramatically reduces unplanned groundings and increases overall aircraft availability.

The aviation industry is poised to enter the digital transformation era, where the majority of the decision-making will be based on AI-enabled systems, from passenger experience to airport operations. These developments create opportunities for OEMs, aircraft component providers, and AI technology developers to differentiate their offerings, reduce life cycle costs for operators, and position themselves early in the transition toward higher autonomy levels across the aviation industry.

Using advanced digital platforms enables seamless integration across manufacturing, supply, and service operations, efficiently catering to customized demands. This approach enables rapid adaptation to technological shifts and regulatory changes crucial for scaling operations. https://www.marketsandmarkets.com